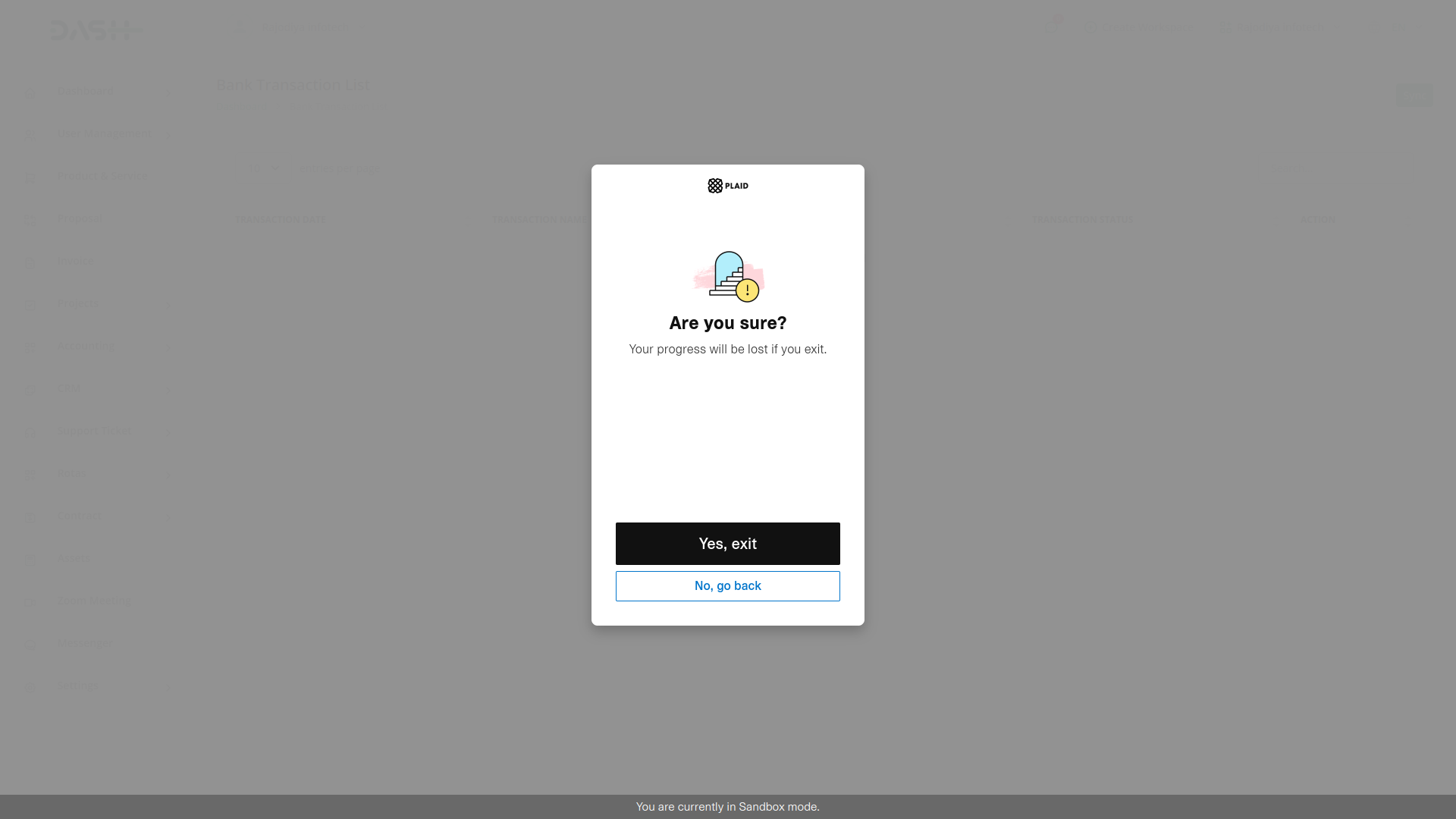

Plaid

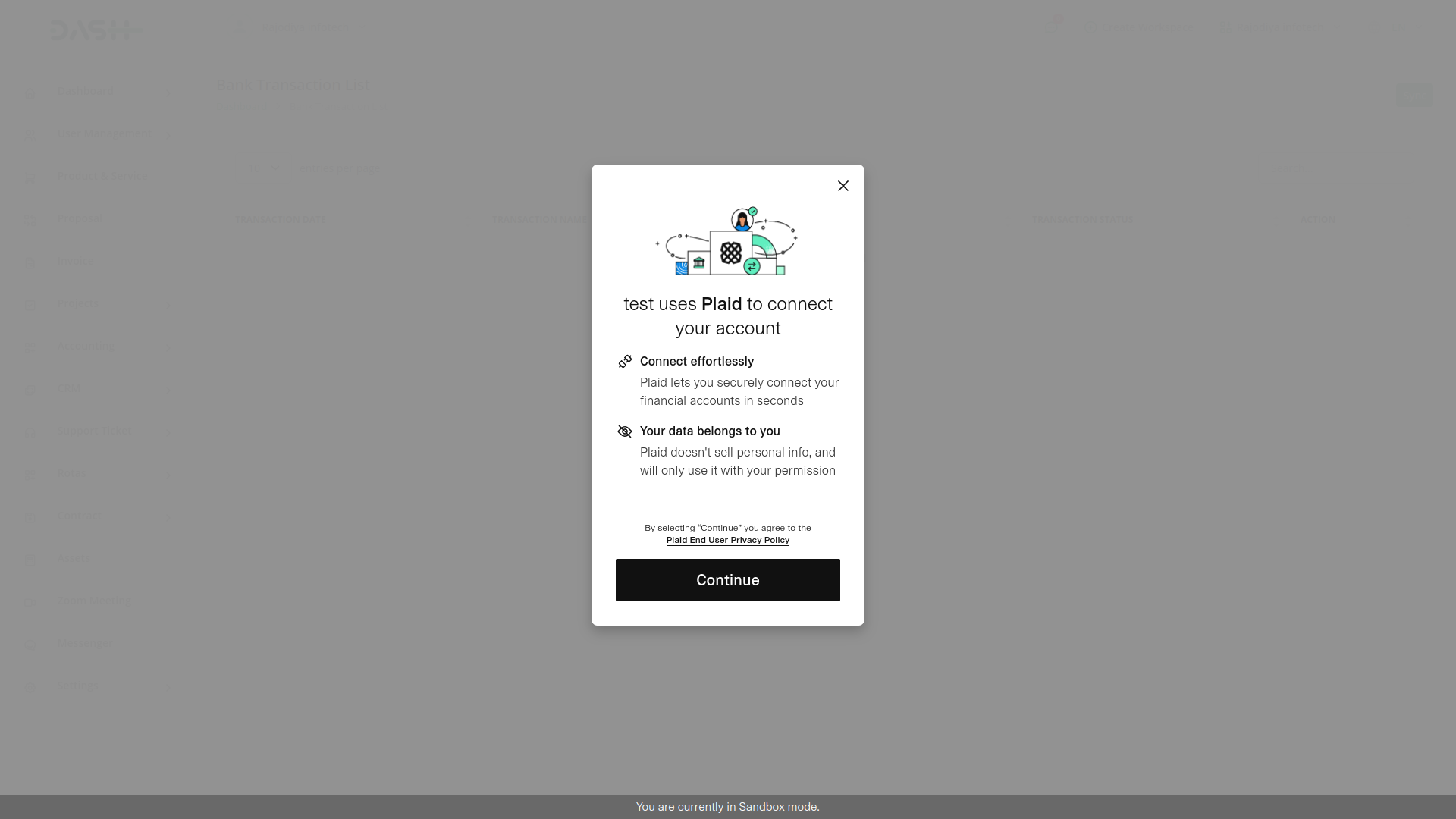

Plaid is a financial technology company that provides a platform for connecting various financial institutions with applications and services. It offers a set of tools and APIs (Application Programming Interfaces) that enable developers to securely access and use financial data from different banks and credit cards.

Thesafer wayfor your users to link financial accounts.

Help people fund their accounts and manage their savings.

Personal finances

Help people manage, budget, and make sense of their money.

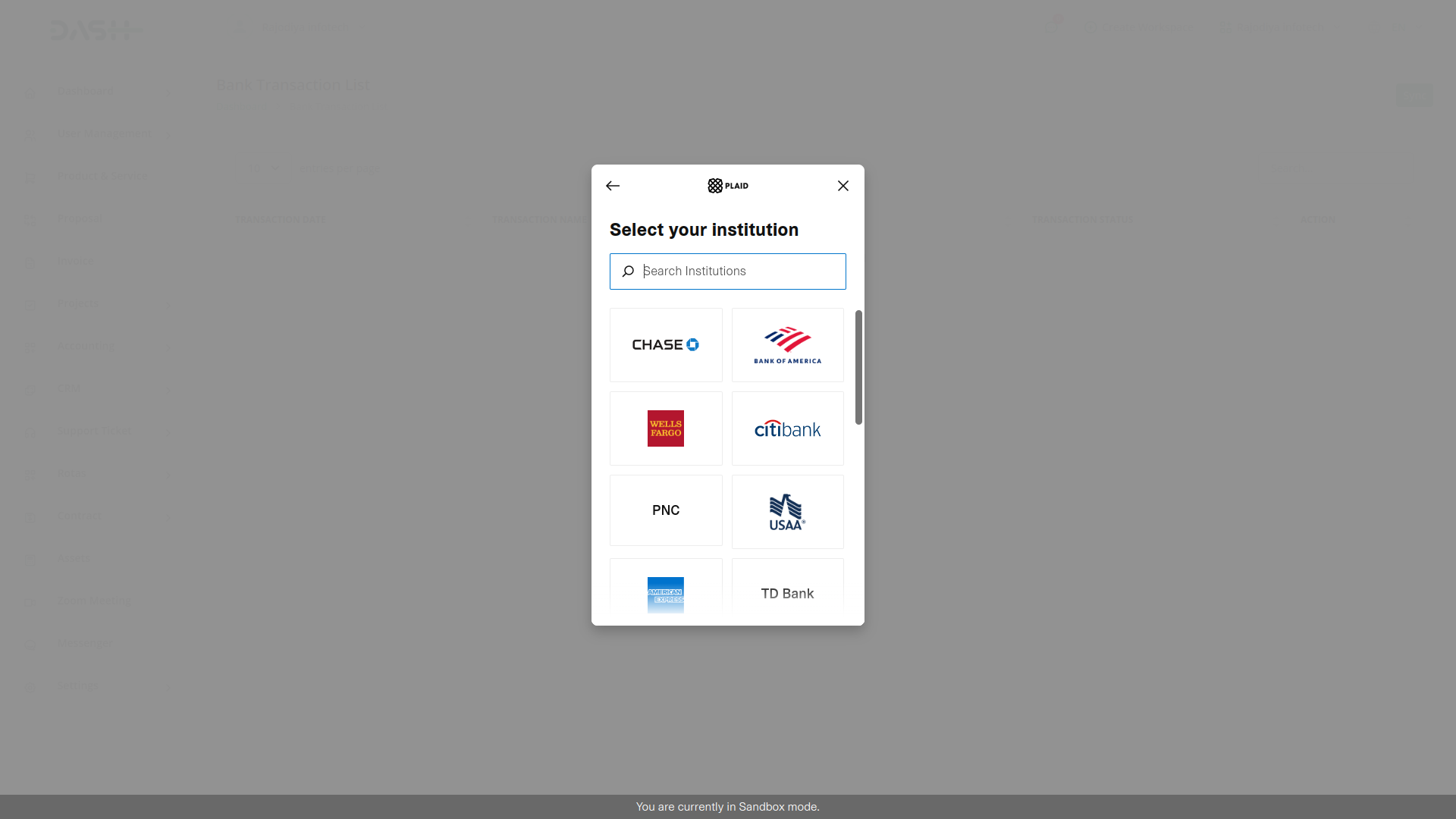

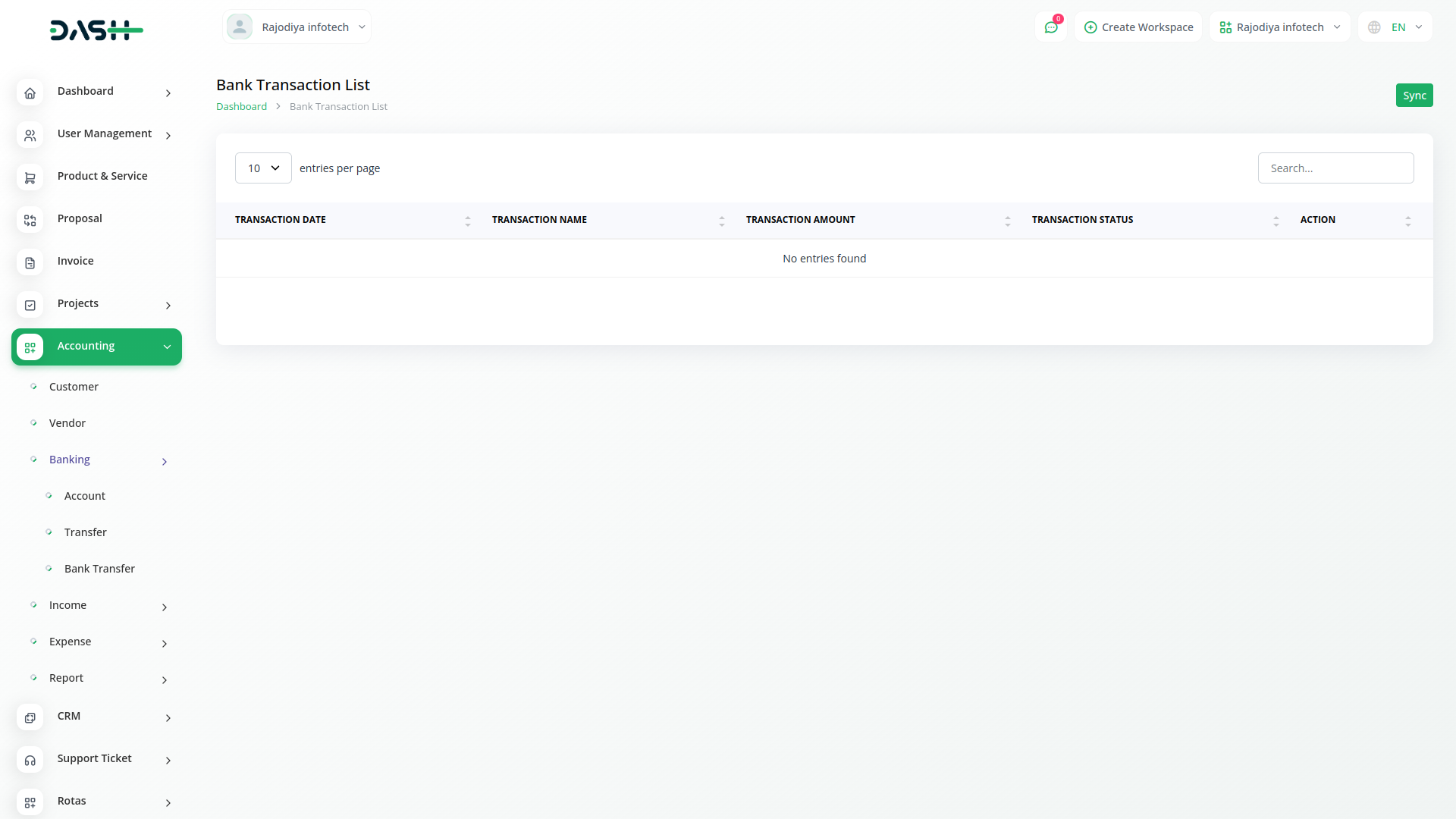

Plaid allows users to link their bank accounts, credit cards, and other financial accounts from different institutions in one place. This simplifies the process of tracking and managing finances across multiple accounts.

Developers can leverage Plaid's APIs to initiate payments from bank accounts, enabling users to make transactions directly from their accounts within an application.

Plaid enables developers to build applications that provide features such as personal finance management, budgeting, expense tracking, and financial planning. By utilizing Plaid's APIs, these applications can securely access users' financial data and provide insights and analysis.

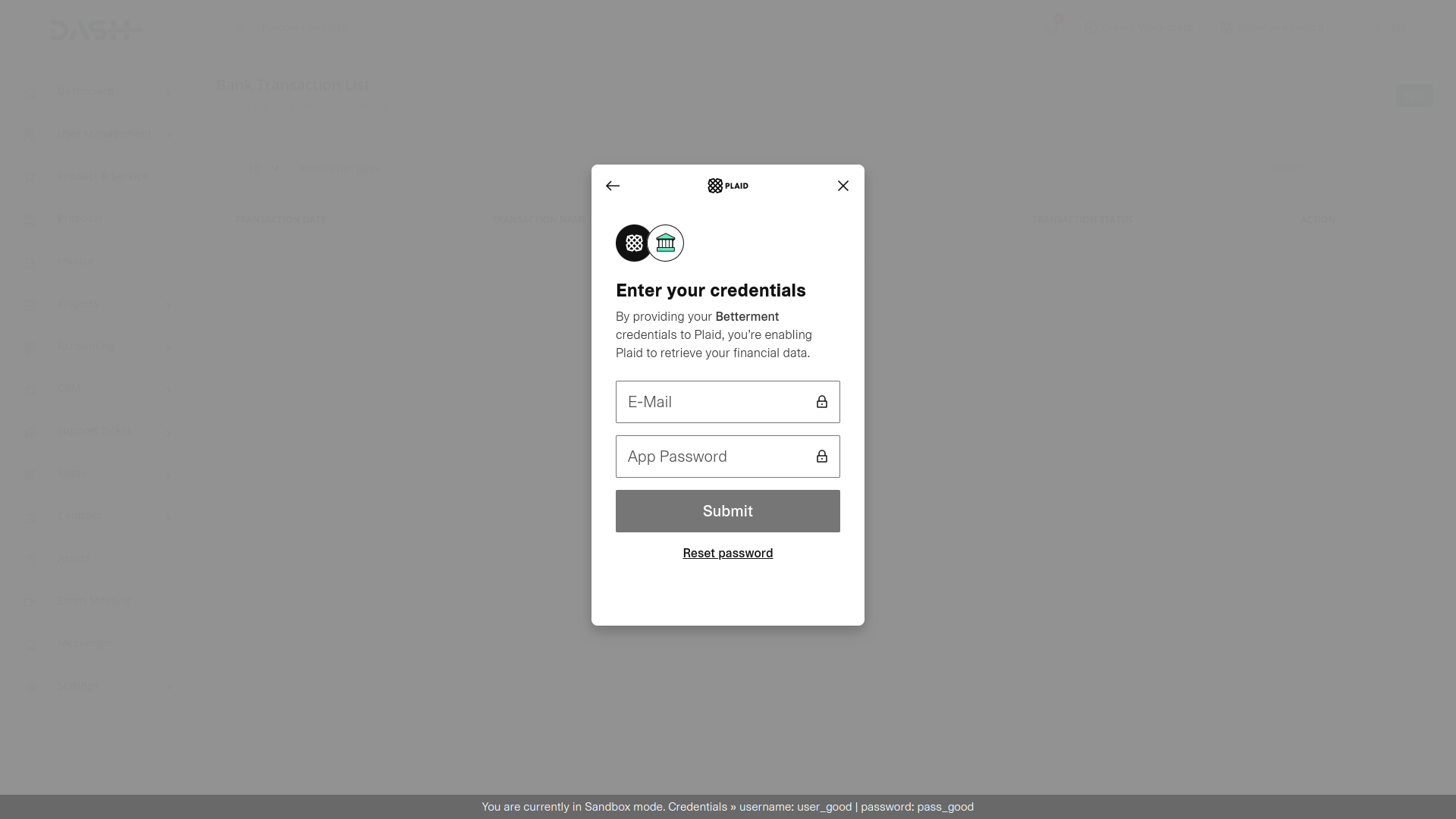

Lending and Underwriting & Identity Verification

Financial institutions and lending platforms can integrate with Plaid to streamline the loan application and underwriting process. By accessing an applicant's financial data through Plaid, lenders can verify income, analyze spending patterns, and assess creditworthiness more efficiently. Plaid's services can be used to verify the identity of individuals during user onboarding or authentication processes. By connecting to users' bank accounts, Plaid can validate their ownership and identity information.

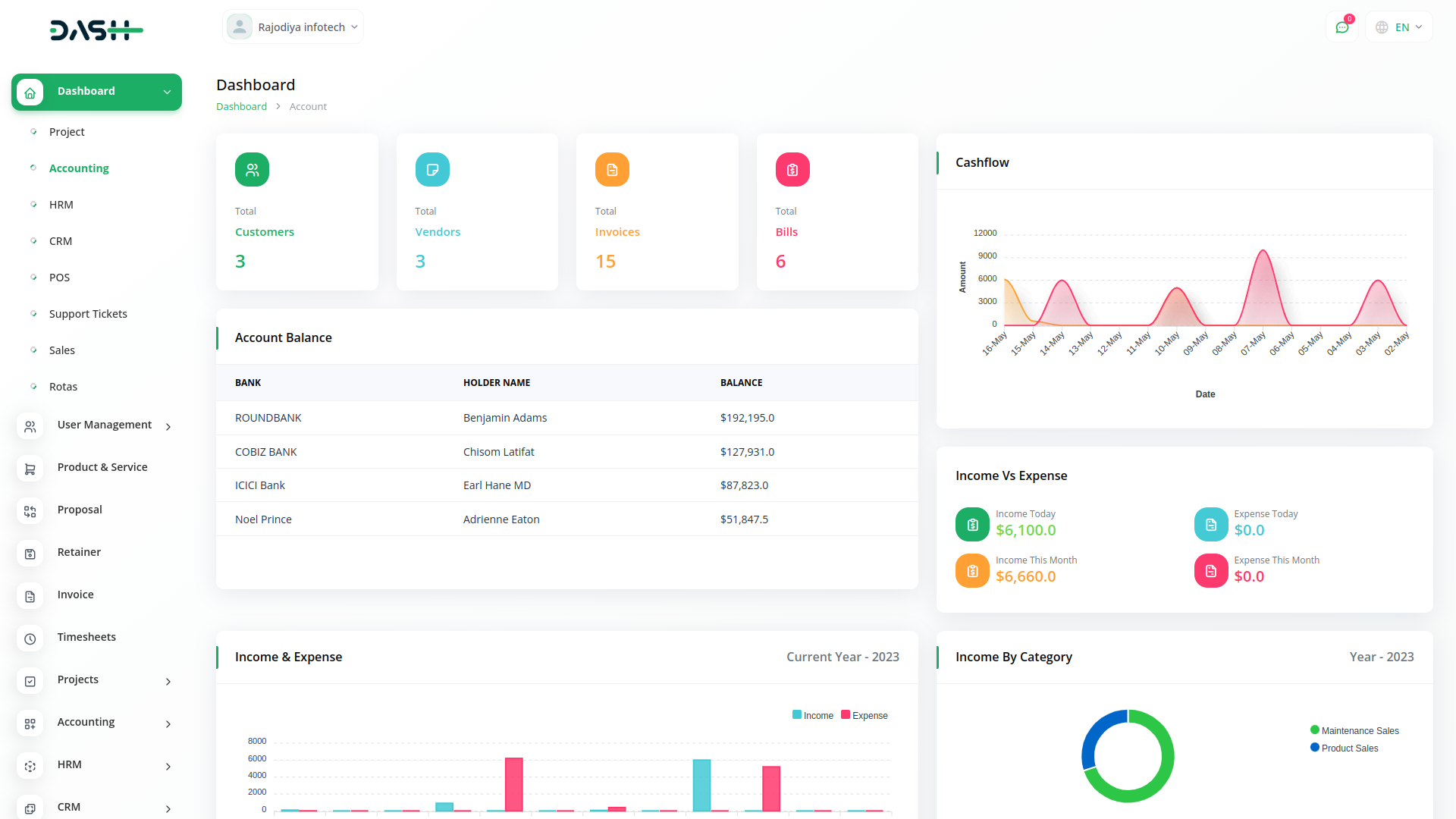

Why choose dedicated modules for your business?

With Dash, you can conveniently manage all your business functions from a single location

Empower Your Workforce with DASH

Access over Premium Add-ons for Accounting, HR, Payments, Leads, Communication, Management, and more, all in one place!

- Pay-as-you-go

- Unlimited installation

- Secure cloud storage

Why choose dedicated modulesfor Your Business?

With Dash, you can conveniently manage all your business functions from a single location.